Find out how much you can pre-qualify for. It’s simple and easy and your information is secure. We're the only ones who'll contact you!

Financial Services

“Helping you expand your financial possibilities” is our slogan. It describes a process whereby our diverse professionals work together, without boundaries, to leverage your financial strengths into greater success for you..

Let us help you get your dream home

“Your home is often the center of your financial universe. We want to help, before - and after - you move in.”

- Rick Radillo

Financial Solutions of California

Mortgage Options

With our partner Quicken Loans, and many other national lenders, we're able to offer you the widest range of loans and options available while delivering the personal touch you need.

Fixed

Adjustable

Jumbo

VA & FHA

Local, friendly, and helpful!

Our goal is to provide you with the kind of integrated financial guidance that makes sense of the many financial issues impacting their lives.

Proudly celebrating 15 years of serving Souther California residents.

Request a FREE consultation

Free Consultation

Frequently Asked Questions

We’ve compiled a list of questions and answers to help you get started

Do I need great credit to get a mortgage?

Not necessarily, but it will certainly help. It is possible to get a conventional mortgage with a FICO credit score as low as 620, and you can obtain a higher-cost FHA mortgage with a score in the 500s. However, be aware that the lower your score, the higher your interest rate will be.

How much of a down payment do I need?

The short answer is that you can get a conventional mortgage with as little as 3% down, an FHA loan with 3.5% down, and a VA or USDA loan with no money down at all. However, with a conventional or FHA loan, you'll have to pay private mortgage insurance, aka PMI, if your down payment is less than 20% of the home's sale price.

Should I choose a fixed-rate or an adjustable-rate mortgage?

When interest rates are historically low, like they are now, a fixed-rate mortgage makes good financial sense. Not surprisingly, the vast majority of mortgages originated today are fixed-rate.

That said, while a fixed-rate mortgage is the best choice for the majority of homebuyers, there are some circumstances where an ARM may be better. For example, if you expect to sell the house before the fixed-interest period ends and the rate starts to float, an ARM could end up saving you thousands of dollars.

Should I get a 15-year or 30-year term loan?

This depends on how much you want to stretch your budget. If you can afford the higher monthly payments, a 15-year mortgage usually comes with a better interest rate than a 30-year version. Not only will you pay off the house quicker, but you can save a tremendous amount of interest. On the other hand, a 30-year mortgage will cost less per month, allowing you to afford a bigger or nicer house, or one in a better location.

What documentation should I gather?

Your lender may ask for many different items, but in general, be prepared to show all of the following:

- Income verification - Last two years' tax returns, W-2s, 1099s, and your last few pay stubs

- Drivers' license and Social Security card (or alternative ID)

- Bank statements

- Proof of funds to close and an explanation of where they came from, if it's not obvious.

- If some or all of your down payment is coming from a gift, you will need a gift letter from the source of the funds that confirm it's not a loan.

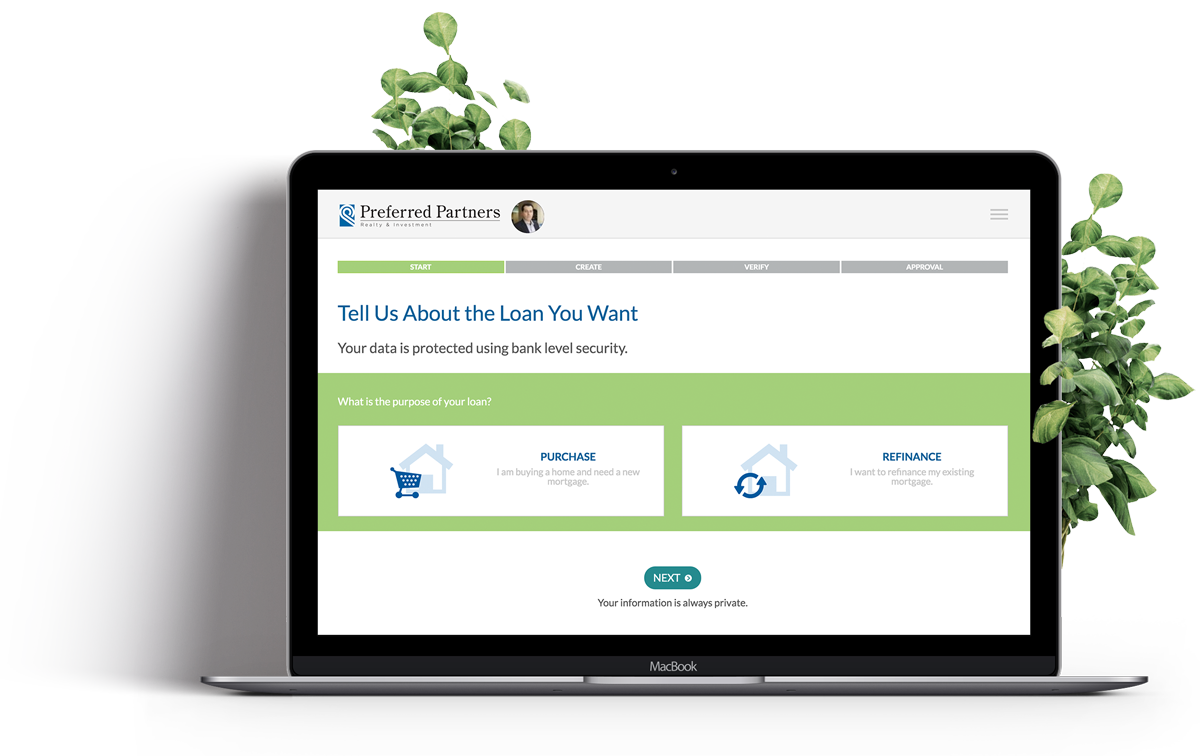

Securely Track Your Loan Online From Start to Close

Find out how much you can pre-qualify for with us. It’s simple and easy. Shop with peace of mind.

Bank level security provided by blink. Always private.

What our customers are saying

I got involved with Mr. Rick Radillo through my oldest brother who knows Rick personally. I was looking to refinance my home so I can get a lower monthly payment on my mortgages. Rick was very professional, intelligent, polite and knowledgeable. He also kept me informed during the whole refi application process! In a matter of 9 weeks, he was able to get me a good interest rate which is half of the previous interest rate that I had. My application was approved without too many conditions. Thank you Rick for all your hardwork and perserverance. I would recommend Mr. Radillo to anyone looking to refi their homes. He's the absolute best!

Atilano H. / Oxnard, CA

These are the most honest, realistic people I have ever dealt with when it comes to buying. I feel as though I made life long friends, who will continuously guide me in the right direction whenever I need any financial advice.

Ellie E. / Long Beach